CFDs is an arrangement made in financial original trading where the differences in the settlement between the closing and open trade prices are financial rules. It’s no surprise that many wealthy people spread their bets across the blockchain start ups and top cryptocurrencies.

Traders and investors can get their hands on cryptocurrency in two ways: by purchasing coins on an exchange or by trading contracts for difference (CFDs) on cryptocurrencies.

Let’s find out the difference between trading cryptocurrencies and CFDs on cryptocurrencies and which is better for investors.

To Start With, What Are CFDs?

To start, let’s talk about what CFDs are.

“Contracts for Difference,” better called the CFDs, are financial instruments that allow traders and investors to trade a range of assets and securities without owning the underlying asset. Instead, traders buy and sell CFDs to get a feel for how the price of an asset moves without having to hold it.

According to a CMC markets review, with CFDs, investors can make money whether the price rise or falls, depending on whether they go “long” or “short.”

How To Make Money With The CFDs?

When trading CFDs, traders make deals with brokers who give them contracts for the underlying asset they want to trade. Opening a long position is the first step for those who anticipate a rise in an asset’s value, while those who expect a decline in its value will sell their initial position.

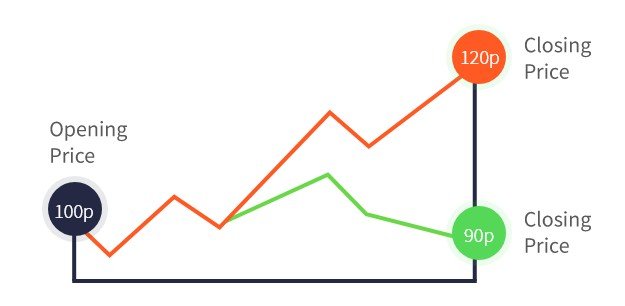

The difference between a position when it is opened and closed is used to determine profits and losses. If traders are correct, the broker pays them the difference between the price when they opened a position and when they closed it, multiplied by the number of CFD units they bought. If a trader loses money, they must pay the broker the difference times the number of CFD units.

Bitcoin CFDs are an example of how cryptocurrency CFDs can be traded.

Crypto CFD lets traders bet on how the prices of cryptocurrencies will change without owning the tokens themselves.

Contracts for difference (CFDs) on cryptocurrencies are popular among investors who wish to profit from market fluctuations but avoid dealing with the complexities of purchasing and keeping cryptocurrencies themselves.

Benefits Of Crypto CFDs

Trading crypto CFDs does not necessitate using an exchange account or wallet to store cryptocurrency.

Traders who purchase and sell crypto CFDs need not be concerned with crypto regulations because crypto CFDs are fully regulated financial instruments.

Trading cryptocurrency CFDs is just like trading any other CFD. Small amounts that can be leveraged can be used to open long or short positions, and traders profit or lose based on the spread between when the position is opened or closed. Since cryptocurrency CFDs don’t have expiration dates like futures contracts, traders can open positions without worrying about fees for rolling over contracts regularly.

Traders can get more exposure to the crypto markets with leverage, even if they only put down a small amount of capital. While margin makes it possible for traders to make big profits with small investments, it also makes losses bigger.

Even though cryptocurrency CFDs work the same way as traditional CFDs, the market in which traders work is different and should be considered. The crypto markets are volatile and don’t always follow the trading rules. Before putting money into a cryptocurrency, traders should learn as much as possible about it and develop a risk management plan that fits with their investment goals.

Learn how to trade cryptocurrency CFDs and get access to the following CFD contracts:

Bitcoin (BTCUSD) (BTCUSD)

Cash in Bitcoin (BCHUSD)

Litecoin (LTCUSD) (LTCUSD)

Ethereum (ETHUSD) (ETHUSD)

Ripple (XRPUSD) (XRPUSD)

Cardano (ADAUSD) (ADAUSD)

Dogecoin (DOGUSD) (DOGUSD)

Polkadot (DOTUSD) EOS (EOSUSD)

Chainlink (LNKUSD) (LNKUSD)

Stellar Lumen (XLMUSD)

The deposit bonus for copy trading

Using a crypto exchange to buy and sell cryptocurrencies

Unlike cryptocurrency CFDs, you need to know how cryptocurrencies work when trading directly on crypto exchanges. Since cryptocurrencies are virtual currencies that run on public blockchains, they are usually decentralized and not controlled by a single group. So, traders must buy and store cryptocurrency safely, which can be challenging for first-time buyers. Users typically trade on the crypto spot market when they buy and sell crypto through a crypto exchange.

The first step to trading cryptocurrencies is to sign up for an account with a cryptocurrency exchange and go through the KYC onboarding process. Then, once the account is funded and a purchase is made, the crypto exchange gives you a hot wallet to store digital currencies and tokens. But this is risky because traders could lose tokens if the exchange gets hacked. So, users should make their cryptocurrency wallet to store tokens. Depending on what they want, traders can use an online wallet, a mobile wallet, a hardware wallet, or a paper wallet.

ALSO READ: Why To Choose Markets.Com? Review And Details & Benefits